“Thus says the Lord: Do justice and righteousness,and deliver from the hand of the oppressor him who has been robbed.”

– Jeremiah 22:3 ESV

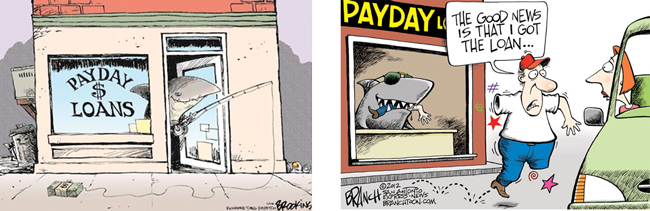

I, a white middle-class woman, am the daughter of parents who have bank accounts with multiple banks and credit unions. When I was a pre-teen my mom took me to the bank and helped me open up a savings account and a checking account. Almost everyone I know back home, both young and old, have a bank account. There are 5-10 mainstream banks and credit unions in my hometown. Banking is the norm where I come from; however, this is not the case for all Americans. Millions of Americans are hunted and consumed by predatory lenders a.k.a. the payday loan industry.

Financial Rape

The payday loan industry is guilty of financial rape. It has financially taken advantage of inner city Americans for the last two decades. When mainstream banks abandoned impoverished neighborhoods, the payday loan industry filled the gap. With more payday lending locations than McDonald’s in the U.S., these companies confidently state that they are often the only available line of credit for people in poverty.[i] Payday lending is a niche financial product that targets subprime borrowers. An estimated 25.6% of all American households, equaling 39 million adults, are either unbanked (individuals without an account at a bank or other financial institutions) or underbanked (individuals that lack access to mainstream financial services usually offered by retail banks). Significant racial and ethnic disparities also exist in terms of access to mainstream financial services. While only 18% of Euro-Americans are either unbanked or underbanked, 53% of African Americans, 43% of Hispanic-Americans and 44% of Native Americans are either unbanked or underbanked. The payday loan industry intentionally targets the underbanked and unbanked populations of ethnic minorities. .[ii]

History

Payday lending was almost unheard of in the 1980’s but materialized in a limited form as the declining income of lower income workers created the dependency of American households on credit to pay routine expenses. By the mid 1990’s second-chance financial businesses realized the profit possibility of accumulating an average of 20% on every dollar loaned out as a cash advance. The temptation of inflated profits from credit-impaired borrowers eventually piqued the interest of Wall Street investors and the mainstream banks.[iii]

Corrupt Line of Credit

All of the major payday lenders receive their credit from the nation’s largest banks: Wells Fargo, JPMorgan Chase, US Bank and Bank of America. By investing in triple-digit interest payday lending, these mainstream banks communicate a callous disregard for their own corporate promises to promote the financial well-being of communities.[iv]

Quick Cash = High Interest Debt

Payday loans are enticing to those individuals who may be cut off from mainstream credit sources. They are reeled in by the promise of immediate access to cash. However, this quick and easy access to cash comes at a high financial price to the borrowers. Payday lenders do not perform underwriting (the process of verifying the information given to the lender from the borrower for the basis of qualification, as well as assessing information on the borrower’s credit history)[v], like the majority of lenders. They simply verify a source of income for repayment.[vi] This type of high-risk lending preys on those who may lack budgeting skills or those in dire need of quick cash- a large percentage of my neighbors. In order to offset potential loan defaults, the payday loan industry strategically charges very high borrowing fees and encourages repeat borrowing to ensure maximized profits. The industry advertises their product as a sensible choice for a one time emergency; however, the reality is that the average borrower takes out nine payday loans per year in a rapid series.[vii]

Villain in Disguise

Payday lenders view themselves as heroic and noble because they are courageous enough to do business where banks are too afraid to invest. They claim they are providing an important service for the individuals who otherwise would have been trapped by their bills due to a lack of access to mainstream banks and/or quick funds. They assert they are helping these people.[viii] Consider the following two scenarios and decide whether or not the payday lender is helping individuals:

- Bill takes out a payday loan. As soon as he gets his next paycheck he pays back the entire outstanding balance plus all of the required fees, which equals over half of what he gets paid. Now Bill is short on cash for the next couple of weeks and will probably take out another payday loan to get himself through until his next paycheck. Bill is stuck in a vicious cycle of taking out loans and paying them back with high interest.

- Danny is an alcoholic with a wife and kids who works part-time. His wife asks him to go get some groceries. Danny does not have any money, so he walks to the Cash-N-Go down the street. He goes inside the Cash-N-Go and grabs some cold hard cash. When he exists, the blinking neon signs from the liquor store adjacent to the Cash-N-Go catch his attention. In minutes Danny spends every cent of the cash on liquor, failing to buy the groceries he originally set out to buy.

As Bill’s poverty increases, the payday lender’s profit increases. At the very least, $3.4 billion dollars of wealth is stripped from low-income, working poor individuals every year in payday lenders’ fees alone. As for Danny, his addiction wins again as easy to access cash is right next door to the liquor store. Danny’s family suffers, while the payday lenders profit. More and more Americans are transitioning from middle-class to economically insecure, and are becoming vulnerable to predatory lending schemes. About 12 million Americans annually acquire long-term debt by taking out a short-term loan. Forty-four percent of borrowers ultimately do not complete their repayments because of the triple-digit interest charged on each loan , thus thrusting them ever closer to poverty.[xi] My friend Antoinette, an African American woman raised on the east side of Indianapolis, shares her experience:

“I was raised on payday loans. My mom started getting payday loans because she was unable to get a bank account due to her amount of debt. The payday loans hurt my family because they took so much money out of my mom’s checks [in order to pay back the high interest loans]. My mom is still on payday loans but I was able to get a bank account. I feel very independent because no one can take extra money from me.”

Northeast Denver

Unveiling the truth about predatory lenders is important to me because they are feasting in my own backyard. The nine neighborhoods of Northeast Denver served by PBC are proof of the payday lenders’ niche population. Our largest ethnic population is Hispanic, followed by African American and then White. 4400 of my neighbors are living in poverty.[xii] Payday lenders have targeted our impoverished and ethnic-minority community. There are fourteen payday lenders in the area but only four banks and four credit unions.

Christian Response to Payday Lending

As Christians, we should view all things and respond to all things, including the economy, through the lens of Scripture. Based on our understanding of economics as seen in Scripture, how should Christians respond to payday lending? The church is commanded to care for the poor. Payday lenders are preying on the poor; therefore, responding to payday lending is a part of us caring for them.

Here are a few practical responses:

- Teach church congregants and neighbors about what the Bible says about money and economics.

- Provide counseling for those who are in debt and help them obtain financial freedom. Explain to payday loan borrowers the truth about the payday loan industry.

- Model stewardship in your own finances and teach others.

- Take the unbanked and underbanked to a trustworthy and credible bank or credit union and help them establish a bank account. For example, my friend Greg took Ragat, a fatherless kid growing up in poverty, to the bank last week and helped him open up a bank account.

- Keep one another accountable regarding bill payments, loans and stewardship.

- When voting in elections pay close attention to items related to payday lending legislation.

- White, middle and/or upper-class Christians should use their power and voice to advocate for the poor and ethnic minorities. For example, encouraging and pressuring mainstream banks to serve the underbanked and unbanked populations, and pressuring payday lenders to close.

- Research your bank. Find out if they are a credit-lender to the payday loan industry. If they are, discuss with them the negative effects of this lending and switch to a bank that is not a credit-lender to payday lenders.

Let us be obedient to God’s command in Jeremiah 22:33 to do justice and deliver those who have been robbed from their oppressors.

Alysa McManus (https://providenceatamilehigh.blogspot.com/ 25 October 12) is a fellow at Providence Center for Urban Leadership Development (PCULD). Alysa’s essay was a result of a discussion we had in our PCULD class on Urban Apologetics. Dr. Mark Eckel has taught as scholar-in-residence at PCULD 8 times this semester.

[i] Somanader, Tanya. “Report: How Payday Lenders Make Billions By Fleecing Americans In Poverty.” ThinkProgress. https://thinkprogress.org/economy/2012/01/19/407365/report-how-payday-lenders-make-billions-by-fleecing-americans-in-poverty/?mobile=nc (accessed October 20, 2012) [ii] “Unbanked and Underbanked.” Wikipedia. en.wikipedia.org/wiki/Unbanked (accessed October 20, 2012). National People’s Action. “Profiting from Poverty.” NPA-US. www.npa-us.org/files/images/profiting_from_poverty_npa_payday_loan_report_jan_2012_0.pdf (accessed October 20, 2012). [iii] National People’s Action. “Profiting from Poverty.” NPA-US. www.npa-us.org/files/images/profiting_from_poverty_npa_payday_loan_report_jan_2012_0.pdf (accessed October 20, 2012). [iv] Ibid [v] Guttentag, Jack M.. The Mortgage Encyclopedia: An Authoritative Guide to Mortgage Programs, Practices, Prices, and Pitfalls. New York: McGraw-Hill, 2004. [vi] Ibid [vii] National People’s Action. “Profiting from Poverty.” NPA-US. www.npa-us.org/files/images/profiting_from_poverty_npa_payday_loan_report_jan_2012_0.pdf (accessed October 20, 2012). [viii] Westergaard, Catherine . “Turning Poverty Into a Multibillion-Dollar Industry.” npr books. https://www.npr.org/templates/story/story.php?storyId=127236038 (accessed October 20, 2012). [ix] “The Positive and The Negative Side of Payday Loans – Ahsenali Investing Portal.” Ahsenali Investing Portal https://www.ahsenali.com/payday-loans-nega-posi.php (accessed October 20, 2012). [x] Somanader, Tanya. “Report: How Payday Lenders Make Billions By Fleecing Americans In Poverty.” ThinkProgress. https://thinkprogress.org/economy/2012/01/19/407365/report-how-payday-lenders-make-billions-by-fleecing-americans-in-poverty/?mobile=nc (accessed October 20, 2012). [xi] Ibid [xii] RNR Design Group. “Building A Way Out of Poverty” Upstream Impact: https://upstreamimpact.org/ (accessed October 20, 2012).

Very helpful and very informative. My wife and I took a drive through Farmington, NM, with a local missionary as our “tour guide.” Between the payday loan places, trading posts, and gambling houses, the Navajos are trapped in real-life scenarios just as you described. It’s a very sad situation.

Alysa–what a difficult subject for you to write about, but what an “eye-opening” statement for me!! I was born during the “depression” and subsequently my view of the monies the Lord has entrusted me with is stringent. I had no idea this situation existed because I have always had the opportunity to “bank” even in a meager way. To understand that others don’t and live their financial lives in this manner is heart-rending!! Thank you for writing this essay even for my eyes alone, and making me aware as “my brother’s keeper” of needs to pray about and care about!!

Another article about this offensive, unjust practice: https://www.christianitytoday.com/local-church/2016/july/texas-pastor-payday-loan-reform-isnt-distraction-its-christ.html